Owning a hybrid car not only benefits the environment but also offers several financial advantages, including tax incentives. Tax incentives can help reduce the cost of purchasing and owning a hybrid car and can vary depending on the make and model of the car and the state in which it is registered. In this article, we will discuss the tax incentives for owning a hybrid car.

What are the tax incentives for owning a hybrid car?

Here are Some points about tax incentives for owning a hybrid car:

- Federal tax incentives: The federal government offers tax credits to people who purchase a hybrid car.

- The tax credit varies: The amount of the tax credit varies depending on the make and model of the car.

- Maximum tax credit: The maximum tax credit available for hybrid cars is $7,500.

- Phased-out tax credit: The tax credit is phased out for each manufacturer after they have sold a certain number of eligible vehicles.

- State tax incentives: In addition to the federal tax incentives, many states offer their own tax credits or rebates for purchasing a hybrid car.

- State tax credit amounts: The amount of the state tax credit varies depending on the state and can range from a few hundred dollars to several thousand dollars.

- State tax credit eligibility: The eligibility for state tax credits may be based on factors such as the make and model of the car, the age of the vehicle, and the income of the buyer.

- State-specific programs: Some states have specific programs that offer additional incentives for purchasing a hybrid car.

- HOV lane access: In some states, hybrid car owners may be eligible for access to high-occupancy vehicle (HOV) lanes.

- Reduced tolls: In some states, hybrid car owners may be eligible for reduced tolls or toll exemptions.

- Sales tax exemptions: Some states offer sales tax exemptions on the purchase of a hybrid car.

- Property tax exemptions: In some states, hybrid car owners may be eligible for property tax exemptions.

- Grant programs: Some states offer grant programs for businesses or government entities that purchase hybrid cars for their fleets.

- Municipal incentives: Some cities offer incentives for purchasing a hybrid car, such as free parking or charging stations.

- Energy-efficient mortgage programs: Some mortgage programs offer incentives for purchasing an energy-efficient home, which may include owning a hybrid car.

- Non-tax incentives: In addition to tax incentives, some states and cities offer non-tax incentives for owning a hybrid car, such as free parking or charging stations.

- Eligible vehicles: Not all hybrid cars are eligible for tax incentives, and eligibility can change from year to year.

- Time limits: The federal tax credit is only available for a limited time and will eventually expire for each manufacturer.

- Eligibility requirements: In order to be eligible for tax incentives, the car must meet certain requirements for fuel efficiency and emissions.

- Manufacturer certifications: The car manufacturer must certify that the vehicle meets the necessary requirements in order for the buyer to claim the tax credit.

- Purchased or leased vehicles: Tax incentives are available for both purchased and leased hybrid cars.

- Documentation required: In order to claim the tax credit, the buyer must provide certain documentation, such as proof of purchase or lease.

- Tax credit carryover: If the buyer’s tax liability is less than the amount of the tax credit, the excess can be carried over to the following year.

- Tax credit refund: If the buyer’s tax liability is less than the amount of the tax credit and they do not have any carryover, they may be eligible for a refund of the difference.

- Other tax incentives: In addition to tax credits, there may be other tax incentives available, such as tax deductions or depreciation.

- Hybrid car trade-ins: Some states offer tax incentives for trading in an old gas-powered car for a hybrid or electric car.

- Hybrid car conversions: Some states offer tax incentives for converting a gas-powered car to a hybrid or electric car.

- Multiple incentives: Buyers may be eligible for multiple incentives, such as both a federal tax credit and a state tax credit.

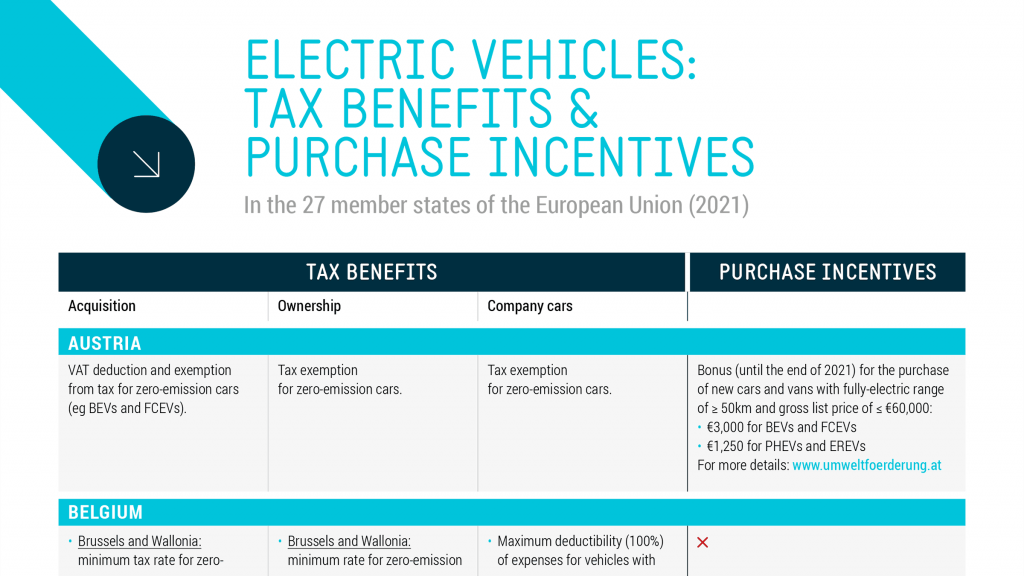

Tax incentives for owning a hybrid car in different countries

Here are the tax incentives for owning a hybrid car in some different countries:

- United States: The federal government offers tax credits ranging from $2,500 to $7,500 depending on the make and model of the hybrid car. Some states also offer additional incentives such as exemption from sales tax and registration fees.

- Canada: The federal government offers a tax credit of up to $2,500 for eligible electric and hybrid cars. Some provinces also offer additional incentives such as rebates and exemptions from provincial sales tax.

- United Kingdom: The government offers a plug-in car grant of up to £2,500 for eligible hybrid cars. There are also exemptions from the London congestion charge and vehicle excise duty.

- Germany: The government offers a subsidy of up to €6,750 for eligible hybrid cars. There are also exemptions from the vehicle tax and reduced rates for the company car tax.

- France: The government offers a bonus of up to €7,000 for eligible hybrid cars. There are also exemptions from the vehicle registration tax and reduced rates for the company car tax.

- Netherlands: The government offers a subsidy of up to €4,000 for eligible hybrid cars. There are also exemptions from the vehicle registration tax and reduced rates for the company car tax.

- Norway: The government offers exemptions from the value-added tax, purchase tax, and annual road tax for eligible hybrid cars.

- Sweden: The government offers a bonus of up to SEK 60,000 for eligible hybrid cars. There are also exemptions from the vehicle registration tax and reduced rates for the company car tax.

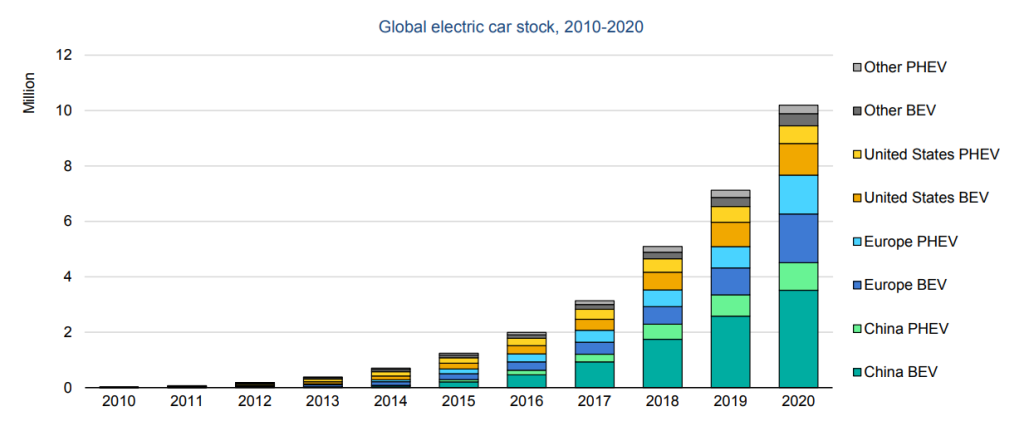

- China: The government offers subsidies ranging from CNY 5,000 to CNY 45,000 depending on the range of the hybrid car. Some cities also offer additional incentives such as exemption from license plate quotas and lottery systems.

- Japan: The government offers a subsidy of up to JPY 2.11 million for eligible hybrid cars. There are also exemptions from the automobile acquisition tax and reduced rates for the automobile weight tax.

- South Korea: The government offers a subsidy of up to KRW 2.5 million for eligible hybrid cars. There are also exemptions from the acquisition tax and reduced rates for the vehicle tax.

- Australia: Some states offer exemptions from stamp duty and registration fees for eligible hybrid cars. There are also reduced rates for the luxury car tax and company car tax.

- New Zealand: The government offers exemptions from the road user charges and reduced rates for the vehicle registration fee for eligible hybrid cars.

- Singapore: The government offers rebates of up to S$20,000 for eligible hybrid cars. There are also exemptions from the annual road tax and reduced rates for the certificate of entitlement.

- India: The government offers a subsidy of up to INR 1.5 lakh for eligible hybrid cars. There are also exemptions from the goods and services tax and reduced rates for the road tax.

Tax incentives for owning a hybrid car in India

- The Indian government offers tax incentives for owning a hybrid car as a part of its National Electric Mobility Mission Plan.

- The tax incentives for hybrid cars in India are provided under the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME) scheme.

- Under the FAME scheme, hybrid cars are eligible for an upfront incentive of up to INR 22,000.

- The FAME scheme also provides incentives to hybrid car manufacturers in India to encourage the production of hybrid cars.

- In addition to the FAME scheme, some state governments in India also offer tax incentives for owning a hybrid car.

- For example, the state of Maharashtra offers a waiver of road tax and registration fees for hybrid cars.

- The state of Delhi also provides an exemption from road tax for hybrid cars.

- Hybrid cars in India are also exempt from the Goods and Services Tax (GST) on electric vehicles.

- This exemption is valid until March 2022.

- Hybrid cars in India are also eligible for a lower tax rate under the Goods and Services Tax (GST).

- The GST rate for hybrid cars is currently 18%, which is lower than the GST rate for petrol and diesel cars.

- The Indian government has also announced a new vehicle scrappage policy, which provides tax incentives for people to replace their old vehicles with new ones, including hybrid cars.

- Under the new vehicle scrappage policy, people who buy new hybrid cars will be eligible for a rebate of up to 25% on the price of the new car.

- The Indian government has also announced plans to increase the import duty on petrol and diesel cars, while reducing the import duty on electric and hybrid cars.

- This move is aimed at promoting the adoption of electric and hybrid cars in India.

- The Indian government has also announced plans to invest INR 10,000 crore (approximately $1.4 billion) in the development of electric and hybrid cars in the country.

- The investment will be used to set up charging infrastructure for electric and hybrid cars in India.

- The Indian government has also proposed to set up a National Automotive Board to promote the development of electric and hybrid cars in India.

- The National Automotive Board will work with the automotive industry to promote the development of electric and hybrid cars in India.

- Overall, the tax incentives for owning a hybrid car in India are aimed at promoting the adoption of hybrid cars in the country and reducing the reliance on petrol and diesel cars.

Tax incentives for owning a hybrid car for different states in India

In India, tax incentives for owning a hybrid car vary from state to state. Here are some examples:

- Delhi: The Delhi government offers a 100% exemption on road tax for hybrid cars.

- Maharashtra: The Maharashtra government offers a 50% exemption on road tax for hybrid cars.

- Tamil Nadu: The Tamil Nadu government offers a 50% exemption on road tax for hybrid cars.

- Gujarat: The Gujarat government offers a 25% exemption on road tax for hybrid cars.

- Karnataka: The Karnataka government offers a 50% exemption on road tax for hybrid cars.

It’s important to note that these incentives are subject to change and may vary depending on the type of hybrid car and its specifications. It’s always a good idea to check with your local government for the latest tax incentives for hybrid cars in your state.

Conclusion

In conclusion, owning a hybrid car comes with several tax incentives that can make the initial cost of purchasing a hybrid car more affordable for consumers. Tax incentives for hybrid cars vary from country to country and state to state, and it’s important to research the incentives available in your area before making a purchase. While tax incentives are just one factor to consider when deciding whether to buy a hybrid car, they can play a significant role in making these Eco-friendly vehicles more accessible to a wider range of consumers. As more governments and organizations prioritize environmental sustainability, we can expect to see continued support for hybrid and other low-emission vehicles in the form of tax incentives and other policies.